Methodology

Keyword analyzes were prepared by analyzing the behavior of real users in order to reach the masses who want to use credit but learn that they can get compulsory credit life insurance with more affordable prices and payment methods, and to identify people who are looking for various types of loans. We then supported it using short and clearly descriptive advertising texts, Callout, Structured, Call, Message Extensions, and Sitelink Extensions, which we directed to the credit directory (blog) filled with valuable information that loan seekers would like to benefit from.

We met with the Aegon Turkey team frequently and explained that we needed to switch to the Data-Driven Attribution Model, where we could measure the value of our entire AdWords account. When they realized the value of this situation, we made a quick decision and made it happen. We also used Position-Based and Time Decay Models for some of our targets. In this way, we are able to analyze how much our traffic source contributes to the transformation based on time, position and with enhanced machine learning.

We have created detailed Funnels via Google Analytics in order to analyze everything that may disrupt the journey of users within the site, and we started our UI and UX studies with the results we received. Our campaigns, which we created, supported the custom dimensions and custom metrics, detailed reports and audience targeting, yielded successful results.

In order to understand our user in more detail, we had to increase our data sources. We started working to combine our offline data with our online data. By activating the Value Track feature, we combined the campaign, word and device analyzes of our traffic sources with the conversion data completed in the call center, and we had the chance to experience the behavior of the users through data analysis. For this, we recommended firstly to update the CRM structures. A very comprehensive project has started to be carried out in this regard. In this way, we have optimized by having Full Funnel control by following Cross-Device Conversion. In this way, we created a never ending UI-UX development process. We continue to improve the process to perfect the Onsite and Offsite user experience.

Innovation

We have developed our targeting with the Value Track parameters we use for data analysis, server logs, and CRM data that we contributed to the development of. We constantly shared the feedback we received with the call center thanks to our analytics events and funnels. Thanks to the feedback the call center gave us about the situations they encountered during the user journey, we performed onpage and landing page optimizations. Thanks to this, our conversion rate increased by 40% compared to the previous year. We have detailed the offline data with the Analytics Audience Targeting feature and transferred it to our AdWords campaigns. Similar Audiences created by AdWords have been of great benefit to us in terms of providing new users. We worked with many partner agencies for UI, UX improvements, A/B testing, and helped improve Aegon’s production and transformation processes. Informing Aegon about Mobile First and Google Machine Learning algorithms, we prepared detailed segmentations with their feedback and prepared the necessary information for the machine learning algorithm to learn.

Another mission as important as reducing lead costs was to create quality leads. We did this by providing follow-up and analysis of the user’s journey on the path of transformation both online and offline. In this way, the basket value increased by 55% compared to the previous year.

Since it is difficult to explain the importance of products to users due to the industry, we combined many different word and ad text variations, call center feedback, real user tests and A/B tests, user behaviors we measured with analytics, and Aegondirekt’s industry experience.

Technology

The custom dimension we created in order to measure quality leads and quality users enabled us to evaluate metrics, events with which we can measure behaviors, and users with credit behavior tendency separately. By combining Gclid with offline user data, we created remarketing lists and transferred them to AdWords with the segments we created with the data we filtered by evaluating them with the behavior, demographic characteristics, products of interest and Life Time Value. Thus, we contributed to machine learning with data-driven and position-based attribution models and tCPA, Maximize Conversion, eCPC strategies, and thanks to these optimizations, we achieved twice as many conversions compared to 2017. Thanks to our Adpro tool, which works by providing data through the AdWords API we also had one more resource to optimize and report on our campaigns.

Our software, which allows us to analyze by pulling data through the Search Console API, provided us with important insights about organic search results and our AdWords searches. In this way, we guided our campaigns with our SEO experience and the data provided by the Google Organic algorithm. Competitor analysis with 3rd party tools also allowed us to create a large database. In this way, we gained a lot of information such as the search style, behavior, demographic characteristics, technologies used and shopping behaviors of the audiences that we can target with quality. We used them for AdWords, Facebook-Instagram and digital media native name purchases. We brought together the data we obtained thanks to the Microsoft BI tool owned by Aegondirekt, and we continue to improve the optimization. Thanks to the tools we developed for AdWords, Analytics, Search Console, Youtube and Facebook-Instagram, we combined the data we created with our user recognition and data segmentation methods in the digital world with the power of a brand like Aegondirekt that knows how to use data, and turned it into concrete steps. We eliminated the garbage data and thus increased the incoming leads by 2 times.

About

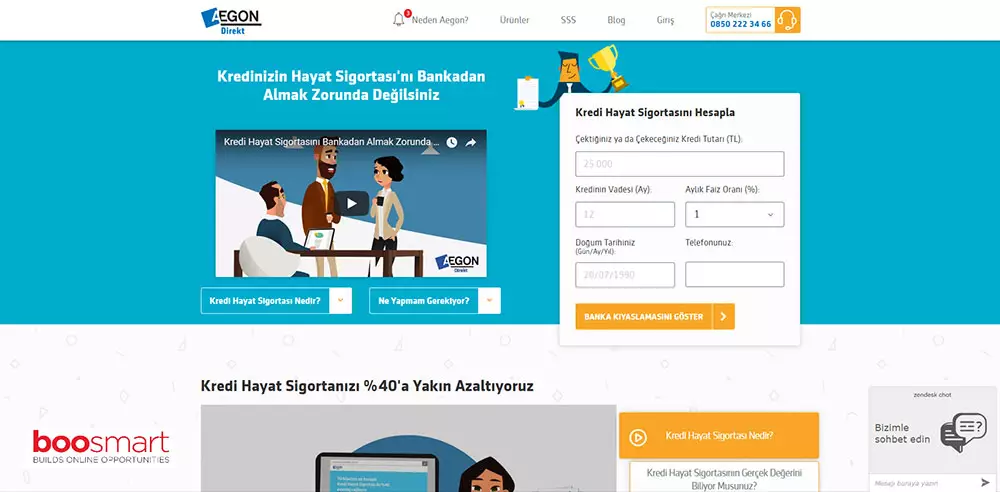

aegondirekt.com.tr

Aegondirekt is the digital start-up project of global insurance giant Aegon, which has been operating in Turkey since 2008. Aegondirekt aims to provide benefits by reaching out to those who want to secure their loans with its Credit Life Insurance product, which is widely used in the Turkish market but it’s still at an infancy level. Aegondirekt aims to provide benefits by reaching out to those who want to secure their loans, with its Credit Life Insurance product, which is widely used in the Turkish market but is still at the initial level of awareness.